6 TIPS TO IMPROVE YOUR CREDIT RATING

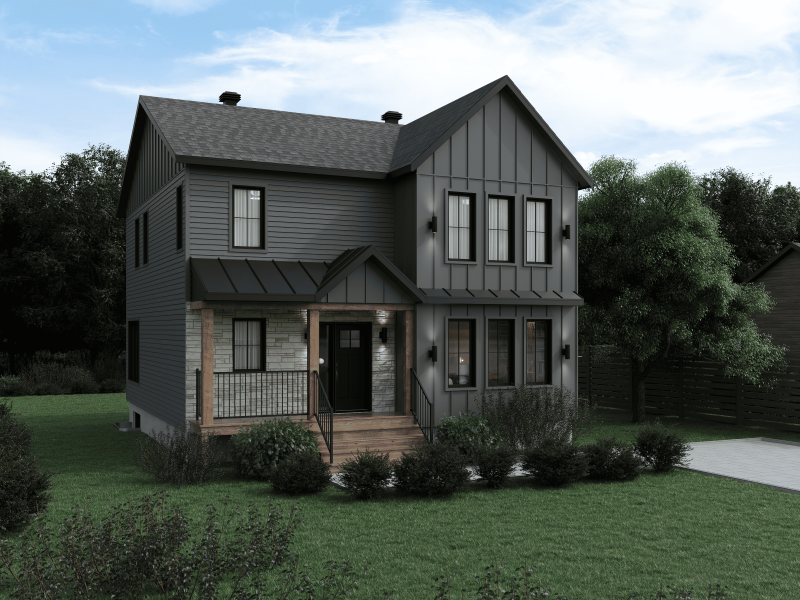

Are you dreaming of buying a property soon? Here are six tips to improve your credit rating and gain access to optimal borrowing conditions, including low‑interest rates.

Your credit rating represents your ability to repay a debt. To estimate it, credit‑reporting agencies gather information on your accounts with service providers, such as electricity, Internet and cell phones. They also analyze your borrowings, including personal loans, lines of credit and credit cards.

These agencies then check your balance, interest rate, authorized limits and payment terms and assign you a score ranging from 300 to 900. The higher the score, the more likely you are to be considered a good payer. If your score is below 500, you may find taking out a new loan difficult. On the other hand, if it’s over 700, you’ll be perceived as an excellent candidate.

1. CHECK THE ACCURACY OF YOUR CREDIT RATING

To avoid unpleasant surprises, check your credit report frequently. You’ll be sure it’s up–to‑date, and should the case arise, you’ll be able to dispute any errors more quickly. Whether you have a loan application or not, it’s a good idea to check your credit report at least once a year. For free online access, visit the Equifax or TransUnion websites.

2. LOWER YOUR CREDIT UTILIZATION RATE

In the best of all possible worlds, your credit utilization rate, including personal loans, lines of credit and credit cards, should not exceed 35% of your authorized limit. For example, if you have a $10,000 limit, you shouldn’t use more than $3,500. In other words, having a higher limit and a lower utilization rate is better than a lower limit that’s regularly reached!

On the other hand, paying the minimum balance each month is not enough to improve your credit rating. With this in mind, be sure to reduce your statement amount as much as possible or in full. On the flip side, make sure you don’t exceed your credit limit, as borrowing beyond the authorized amount will significantly damage your credit rating.

3. PAY YOUR BILLS BEFORE THE DUE DATE

Your payment history undoubtedly has the greatest influence on your credit rating. So avoid paying your bills late, which could put you at a disadvantage for a long time – even years in some cases! In other words, always pay before the due date.

Think you can’t make a payment? Contact your lender to inform them of the situation and prevent any damage to your credit file. Above all, don’t skip any payments, even if the bill is in dispute. You’ll have plenty of time to find a compromise later without worrying about the repercussions on your credit file.

4. LIMIT YOUR FINANCING REQUESTS

A note is added to your file every time you apply for financing. If you want to buy a new car, get a mortgage or change your insurer, try to do it within two weeks. Your requests will then be grouped together so that you won’t be penalized. In other words, the more requests you make, the more you give the impression of living beyond your means, and the greater the risk of getting into debt.

However, not all credit checks have an impact on your file. This is particularly the case when you:

- Request access to your own credit file

- Authorize a company to consult your file to update its documents

5. CONSOLIDATE YOUR DEBTS

Do you have more than one personal loan or credit card? Consider consolidating your balances in one or two places at most. Here’s a tip: identify the cards with the best interest rates to get the most out of them, then pay off the full balance of the others.

If some accounts are unused, don’t close them right away. The older they are, the easier it is to assess your repayment habits. This will help you demonstrate that you are a stable payer.

6. DRAW UP A DETAILED BUDGET

Our best advice for improving your credit rating: draw up a precise income and expenditure budget. This will help you identify the debts you need to pay off first to reduce your debt‑to‑income ratio.

In sum, improving your credit rating is one of the first steps you need to take to make your real estate project a reality. Once you’ve put this strategy in place and obtained your mortgage pre‑approval, make an appointment with our team of experienced professionals to discover all the advantages of a manufactured home.

1https://www.journaldemontreal.com/2020/11/21/comment-ameliorer-sa-cote-de-credit-rapidement

2https://www.canada.ca/fr/agence-consommation-matiere-financiere/services/dossier-pointage-credit/ameliorer-cote-credit.html