5 Effective Strategies to Save for Your Down Payment in 2025

Prepare for Your Purchase, One Dollar at a Time

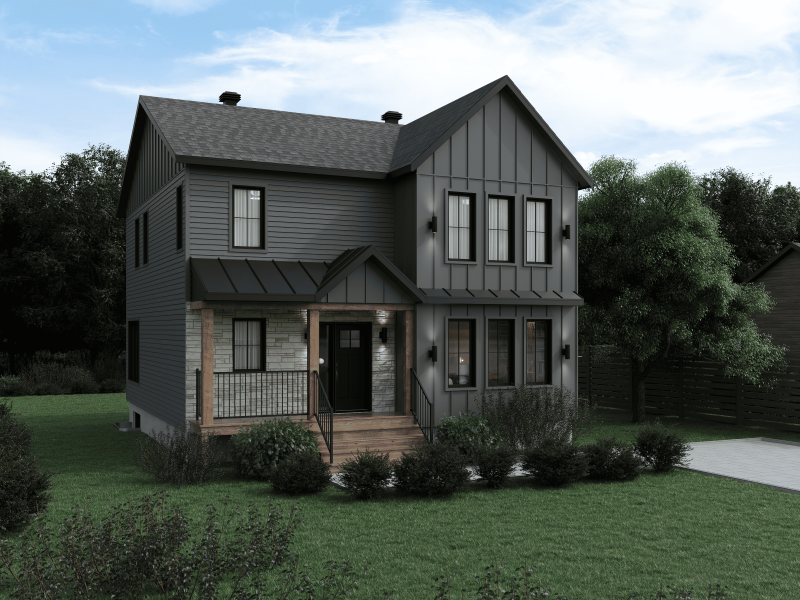

Dreaming of owning a ProFab prefabricated home? Before making that dream a reality, it is essential to gather the necessary down payment. In 2025, several tools and programs are available to make this crucial step easier. Here are five proven strategies to help you reach your goal faster.

1. Understand the Required Down Payment Amount

Source: CMHC

Example 1: For a new manufactured home priced at $350,000, you will need at least $17,500 as a down payment.

Example 2: For a $650,000 property, the minimum down payment is:

5% of $500,000 = $25,000

10% of $150,000 = $15,000

Total required down payment = $40,000

2. Assess Your Current Financial Situation and Get Pre‑Approved for a Mortgage

3. Maximize Your Tools and Government Assistance

In 2025, several savings plans and government incentives are available to help you buy a home. By combining these tools, you can accelerate the accumulation of your down payment and reduce your borrowing costs.

Tax‑Advantaged Savings Tools

Home Buyers’ Plan (HBP): Allows you to withdraw up to $60,000 from your RRSP tax‑free, repayable over 15 years.

Source: Government of Canada

First Home Savings Account (FHSA): Contribute up to $8,000 per year, with a lifetime limit of $40,000, entirely tax‑free upon withdrawal.

Source: Government of Canada

By combining the HBP and FHSA, a couple could accumulate up to $168,000 toward their home purchase.

Homebuying Assistance Programs

First-Time Home Buyers’ Tax Credit: Up to $10,000 in tax credit, equal to a $1,500 tax savings.

Source: Government of Canada

First‑Time Home Buyer Incentive: Offers a federal shared‑equity mortgage of 5% to 10% to reduce your mortgage loan.

Source: CMHC

Family Access Program – City of Québec: This initiative offers an interest‑free loan covering up to 5% of the purchase price of a new or existing home, repayable only upon resale of the property. It is intended for families with at least one minor child, subject to certain income and residency conditions. This program is particularly beneficial for young families looking to become homeowners in the Québec City region.

Source: Quebec City

Consult your advisor or an official website to check your eligibility.

GST Relief on New Homes: As of May 2025, the federal government has announced a full GST relief for first‑time buyers of a new home purchased from a builder, provided the value does not exceed $1 million. A partial relief will be granted for new homes valued between $1 million and $1.5 million.

This is a major benefit for future owners of newly manufactured homes.

Source: Department of Finance Canada

4. Automate Your Savings to Stay on Track

Automation turns saving into a habit and helps you stay consistent with minimal effort. Here is how to set up a simple and effective system:

- Open a separate account dedicated to your down payment, ideally at a different financial institution to make it harder to dip into.

- Set a realistic savings amount to contribute weekly or monthly based on your budget. For example, saving $150 per week for two years adds up to over $15,000.

- Schedule an automatic transfer on payday so the money is saved before you are tempted to spend it.

- Adjust the amount over time, especially after a raise or once a debt is paid off.

- Track your progress using a budgeting app or a simple spreadsheet to stay motivated.

5. Optimize Your Personal Finances